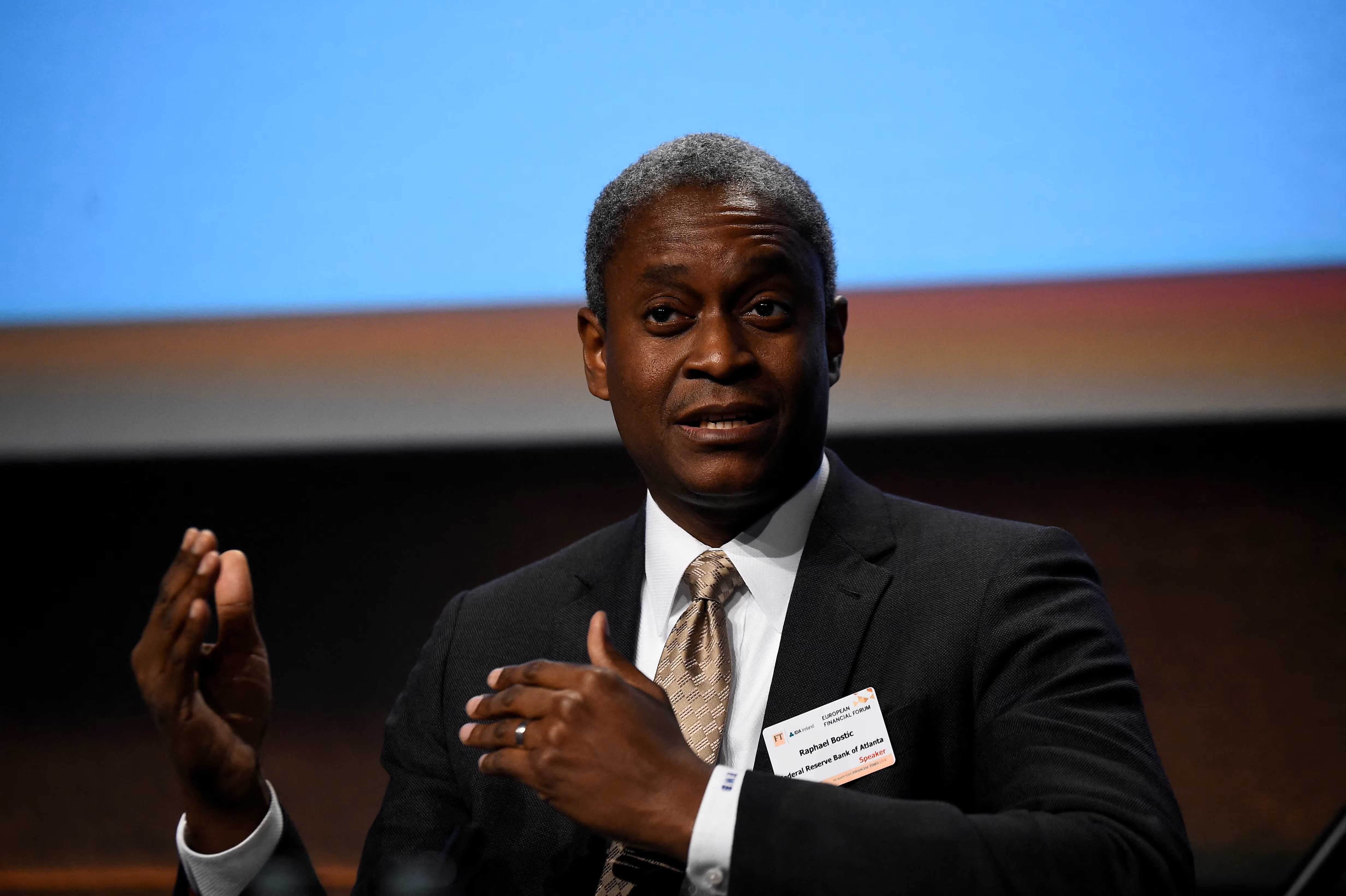

Rate Cut Not Now: Bostic Signals 'Hold On'

Raphael Bostic, President of the Atlanta Federal Reserve, made one thing clear: inflation is still too high and needs to be brought down. In an interview with CNBC on Friday (January 30th), Bostic argued that the Fed should be more patient—because price pressures haven't truly "tamed down," and there's even a risk of stagnant inflation for much of this year.

Bostic said that over the past two years, inflation has tended to stagnate, and he still sees "waves" of tariff impacts that haven't fully penetrated prices. That's why he emphasized the need for the Fed to remain vigilant, not rush to loosen policy simply because the market expects a rate cut.

On interest rates, his message is clear: there's no need to cut now. Bostic said there's currently an argument that inflation risks and employment risks are relatively balanced. However, he added that the risk of serious labor market weakness still feels more distant than before—meaning there aren't any warning signs strong enough to "force" the Fed to cut rates.

From the business side, Bostic said his recent contacts with businesses sounded more calm about inflation. He doesn't expect inflation to spike again, but he also believes it could remain high—in other words, it won't be easy to reduce quickly. Therefore, he emphasized that two interest rate cuts is not his current base case scenario.

Bostic also touched on the hot topic of Kevin Warsh. He admitted he doesn't know Warsh well, but has heard him to be "quite wise." However, he emphasized that interest rate decisions aren't a one-person affair—the FOMC has 12 voting members, and the dynamics at the table can differ from public perception.

Finally, Bostic also highlighted the Fed's balance sheet. The balance sheet has expanded due to the crisis, but he believes the Fed should gradually reduce its government bond holdings and focus on holding more "market-appropriate" securities. He believes the current balance sheet is appropriate, but it needs to grow with economic growth—at the same time, the Fed's independence remains an issue that needs to be maintained and monitored, including how Warsh will carry out his role.

Source: Newsmaker.id