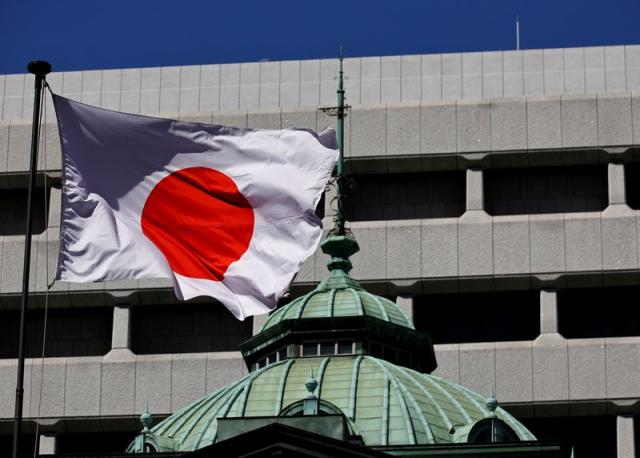

BOJ Chief Vows To Scrutinize Impact Of U.S. Tariffs In Policymaking

Bank of Japan Governor Kazuo Ueda said Wednesday that the central bank will closely analyze how U.S. tariffs could affect the economy when making monetary policy decisions.

"Domestic and overseas economic uncertainties have increased due to U.S. auto and retaliatory tariffs," Ueda told parliament.

"We will continue to closely analyze how tariffs could affect Japan's economy and prices through various channels."

The BOJ exited its radical stimulus program last year and raised interest rates to 0.5% in January with the view that Japan was on the verge of achieving its 2% inflation target on a sustained basis.

Trump's decision to impose broad tariffs around the world, including in Japan, has complicated the BOJ's plans to continue raising interest rates from their low levels.

Ueda said the BOJ's previous decisions to raise rates were made with a focus on underlying inflation, which has been gradually rising toward 2%.

The decision was also based on the view that withdrawing excessive monetary support now would help the BOJ avoid sharply raising interest rates later to address excessively high inflation, and ensure Japan’s economy achieves sustainable growth, he added.

Asked by a lawmaker to deliver a more forceful statement committing to addressing the economic drag from Trump’s tariffs, Ueda said only that there was still uncertainty about how U.S. trade policy would play out.

“We will scrutinize developments, analyze how they affect the economy, prices and markets to come up with a solid projection, and guide policy appropriately,” Ueda said.

The BOJ’s next policy meeting is April 30-May 1, when the board is seen keeping interest rates steady at 0.5% and issuing new quarterly economic forecasts.

Source: Investing.com